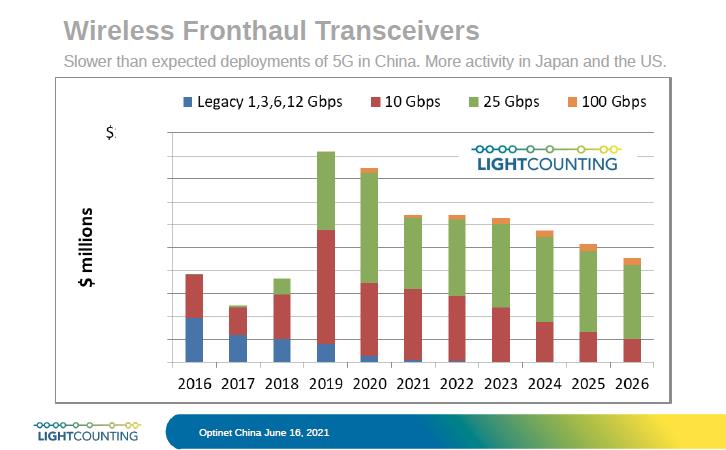

Recently, many people in the optical fiber industry chain have said frankly that the demand for 5G is not as good as expected. At the same time, LightCounting also pointed out in the latest report that 5G deployment is slowing, especially in the Chinese market. Do not have much hope for the return of 5G fronthaul demand in the short term.

At the same time, in the field of 5G fronthaul, the three major domestic operators have launched innovative solutions. But so far, the centralized procurement of the three major operators has not purchased innovative solutions on a large scale, and is still dominated by traditional passive CWDM. As an important part of related solutions, optical module manufacturers have followed up one after another, and the delay in large-scale procurement has also put pressure on early investment manufacturers.

the latest report that 5G deployment

In addition, since the industry was generally optimistic about the prospects of the 5G market at the beginning, before the start of the 5G cycle, in addition to the early deployment of traditional optical module manufacturers, optical equipment, optical fiber and cable companies also gathered together to enter. In addition, many communications listed companies have also entered this market with the help of capital. The slowdown in overall 5G demand may also make these companies a little confused.

However, overall, the development of my country’s optical module market is still in the growth stage. According to market reports, China has already accounted for six of the world’s top 10 optical module companies, compared with only one 10 years ago. There are also many Chinese optical module companies ranked 10th to 15th.

In addition, although the demand for 5G is difficult to return in a short time, it is still growing rapidly in the fields of data communication optical modules and next-generation access network modules. The rising capital expenditures of top cloud service vendors and the acceleration of gigabit optical networks are good evidence.

LightCounting data shows that by 2026, the average annual compound growth rate of the 400G high-speed optical module market will reach 20.5%. In 2021, the 400G optical module market will exceed US$1 billion, an increase of 140% year-on-year.

Of course, although domestic optical module manufacturers are already in the top position in terms of overall market share or global rankings, there is still a certain gap in the fields of high-end optical and electronic chips, and they are still catching up. Chip production module is the status quo of the industry, but there has been some progress. 25G DFB/EML optical chips and 25G/50G electric chips have entered the practical stage of mass production. And it has continued to make breakthroughs in the production and manufacturing of high-end optical modules.

As the leader in data communication optical modules, InnoLight Technology has always been in a leading position in the high-end optical module market. In order to maintain its competitive advantage, it plans to invest nearly 3 billion yuan this year, aiming at the large-scale production of 400G high-end optical modules, and the research and development and development of 800G optical modules. Put into production.

Feipu Technology, a wholly-owned subsidiary of Sichuan Guangheng Communication of YOFC, held the “Project Completion and Commencement Ceremony of Annual Production of 10 Million High-end Optical Components and Optical Modules” in Meishan City, Sichuan Province recently, supporting the diversification strategy. At the same time, it also contributes to the development of the domestic high-end optical module industry.

When AMINI entered the optical module industry, it has been positioned to design and manufacture high-end optical modules. In 2020, it will release 400G silicon optical modules and achieve large-scale mass production in 2021. In this year’s OFC, the 800G silicon optical module was released again, achieving another breakthrough in the field of high-speed optical modules and ranking among the main track of high-speed optical modules.

After Cambridge Technology acquired Lumentum’s optical module production line, it actively integrated, focusing on optical modules above 100G and gathering in the high-end optical module industry.

Therefore, the slowdown in demand in a certain market will always be filled by another field. More importantly, it is to cultivate internal strength and maintain its own competitiveness.